Keynes insight

By Luke Fiedler, ’10

Photography by Dan Dry

In 1936 British economist John Maynard Keynes published The General Theory of Employment, Interest and Money, a book that helped shape modern macroeconomics. Written during the Great Depression, it was understood as a justification for government intervention to help the market restabilize and maintain full, competitive employment. Keynes argued against the idea that people and institutions would always behave rationally in the marketplace, in exact accordance with classical economic theories.

The subsequent Keynesian Revolution challenged the idea that the free market would naturally right itself during a crisis. “Basically, Keynes threw out most of economics,” argues free-market economist and Chicago Booth finance professor John Cochrane. At the same time, he adds, Keynes “made what look to classical economists like basic mistakes.”

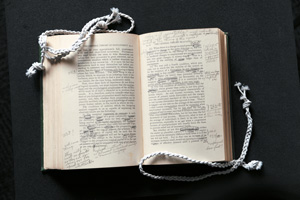

Make that lots of mistakes, according to former Chicago economics chair Frank H. Knight. The Regenstein’s Special Collections Research Center houses a copy of The General Theory that Knight heavily annotated—on some pages the original print is almost unreadable. Famously opinionated, Knight taught at the University from 1929 until his 1972 death, and he stuck to laissez-faire economic policy throughout the New Deal. He also helped establish the Chicago School of Economics, arguing that government programs were inherently too simplistic to accommodate the market’s complexities. Interventionism was worse than simply a failing market; it meant stifling personal independence. Knight’s marked-up copy of The General Theory embodies the Chicago School’s appraisal of Keynesian economics, Cochrane says: “a 40-year-long detour only put right” by Nobel Prize–winners Robert Lucas, AB’59, PhD’64, and Milton Friedman, AM’33.

In today’s recession, Knight’s notes make the Regenstein’s copy of The General Theory a “gorgeous document,” Cochrane says, “standing at the founding of the Chicago School’s opposition to Keynesian orthodoxy and its eventual success.”