There's a resounding drumbeat from economic doomsayers in America, an overture played by pundits and politicians: the poor are getting poorer. The middle class is shrinking. The economy is worse for families than ever before.

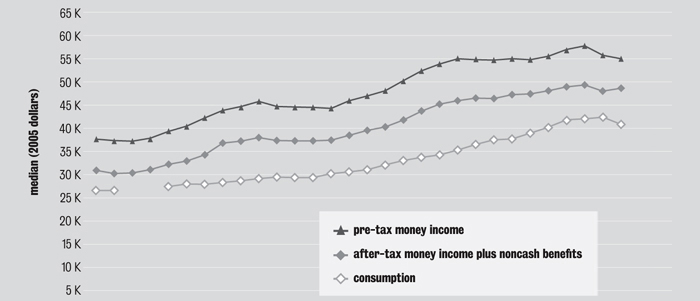

But the pulse of the American economy sounds different to Bruce Meyer, a McCormick Foundation professor at the Harris School of Public Policy Studies. In a paper to be published by the American Enterprise Institute, Meyer finds "considerable improvement" in the material well-being of middle-class families over the past three decades. Median income and consumption both rose by more than 50 percent between 1980 and 2009. "The middle class is much better off than they were ten years ago, much better off than they were 30 years ago," he says. "That's a message that you don't always hear."

The Chicago economist has been studying how the United States measures poverty and material well-being since the early 1980s, when he was a graduate student at MIT. One problem, he says, stems from where the nation gets its data. Middle-class well-being numbers, for instance, come from income reported in the Current Population Survey, which the government uses to calculate official unemployment, poverty, and other policy reports.

That survey, Meyer explains, ignores tax credits, savings, and government benefit programs such as food stamps and housing assistance that act like income, all of which contribute to higher standards of living (the study also investigates the poor's improved well-being). Other inaccuracies include under-reported income and incorrect inflation estimates.

Readjusting inflation alone, Meyer's calculations, done with coauthor James Sullivan from the University of Notre Dame, show that the average median income rose by 46 percent between 1980 and 2009, compared to the 17 percent increase that the government previously reported. "If we're getting bad data, we're going to make bad decisions," Meyer says. "We're going to spend money inefficiently, we're going to spend money on the wrong people"—those who don't need it—"and we're going to think that some government programs aren't reaching as many people as they are."

When the researchers looked at consumption, particularly middle-class housing and automobile expenditures, a similar narrative emerged. Today middle-class homes are bigger by nearly 300 square feet than they were in 1989. The prevalence of air-conditioning, dishwashers, and clothes dryers rose as well, while expensive problems such as plumbing and roof leaks declined sharply.

Car ownership and quality spiked too, Meyer found. The fraction of middle-class families with more than one car rose by 4.4 percentage points between 1999 and 2009, to 37 percent. Those second and third cars were more likely to have extra features such as power brakes, power steering, and sunroofs; most noticeably, the fraction of cars with air-conditioning rose more than 35 percentage points between 1981 and 2004. More of those features are now standard, Meyer says, "but that's the point. It reflects that what people expect and what your money can buy has changed a lot. It's not that those features don't have value; it's that everybody is benefiting from improvements in the quality of cars and quality of life in general."

Meyer often fields questions about credit-based consumption. His answer: it all evens out. "If people are overspending their means, then eventually they're going to underspend when they pay back debts or when they can no longer borrow."

Given the current recession, he understands why many people don't see the bigger picture. But step back, he says, and those small peaks and troughs of a struggling economy meld together. A single line ascends. It's a middle-class moving, as it has always been, up.

"We should be doing less hand wringing about the country falling apart," Meyer says. "We should always be worried about our kids, but it doesn't look like we're going to leave them declining or worse living standards. We may leave them other problems, but this doesn't look like it's one of them."