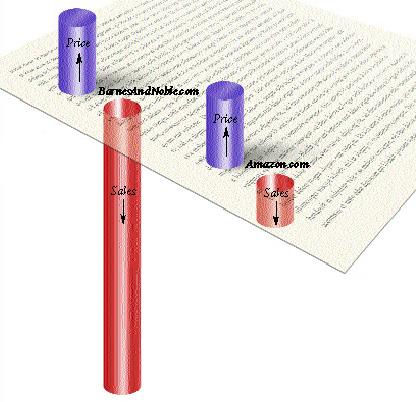

Fig.1

Fig.1

On

the same page?

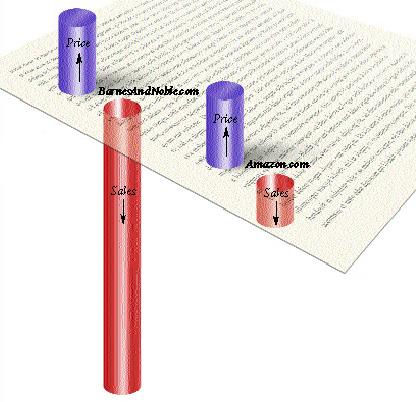

While the two leading online booksellers, Amazon and Barnes

and Noble, are sensitive to pricing, B&N is much more

so than Amazon. Extrapolating sales-quantity figures from

the sales-based book rankings each outfit lists on its Web

site, GSB economist Austan Goolsbee and Yale economist Judith

Chevalier found that a 1 percent price increase at B&N

reduces sales by 4 percent. The same price increase at Amazon,

meanwhile, reduces sales by only 0.5 percent.

Goolsbee, whose research will appear

in the June Quantitative Marketing and Economics,

has no easy explanation for the large gap. Amazon’s

heavy investment in customer loyalty could not be the only

answer, he says. Economic theory suggests that even in a

monopoly a 1 percent price increase would slash sales by

1 percent—double that of Amazon. Perhaps Amazon prices

its books artificially low, Goolsbee speculates, to attract

customers who will also buy higher-priced products or who

won’t switch when Amazon later raises prices.

—A.B.

![]() Advertising

Advertising

![]() About

the Magazine

About

the Magazine ![]() Alumni

Alumni

![]() UChicago

UChicago

![]()

![]() ©2003 The University

of Chicago® Magazine

©2003 The University

of Chicago® Magazine ![]() 5801 South Ellis Ave., Chicago, IL 60637

5801 South Ellis Ave., Chicago, IL 60637![]() fax: 773/702-0495

fax: 773/702-0495 ![]() uchicago-magazine@uchicago.edu

uchicago-magazine@uchicago.edu